Good morning Traders!

I think it’s fair to say that Gold has not recently behaved in a manner expected- the old adage that Gold is a hedge against inflation does not seem to hold true anymore.

That being said, there’s some reliable evidence that Gold is making a slow and determined comeback.

This doesn’t mean that it will be a smooth comeback, though.

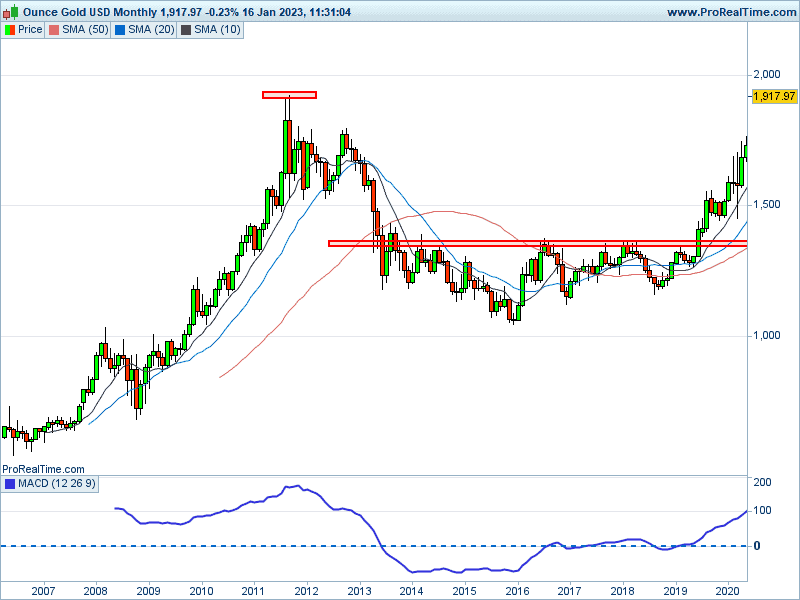

It’s well worth recapping about key moments in the past where the fervour for Gold matched the recent lust for Bitcoin, leading to big bubbles and fortunes lost.

In 2011, and up until that point, Gold was such a steady, reliable commodity, that it’s behaviour was as close to a certainty as any instrument could be. There was no erratic behaviour or spikes.

But, as Gold began to turn parabolic and shoot skyward, it eventually hit a brick wall at $1,900. After battling against it, while the media and social networks were aflush with unlimited ‘end-of-the world-as-we-know-it’ documents and PDF’s about how Gold would never collapse, but that society was about to, Gold broke below $1,400 and stayed there for 6 years!!

The point here is that anything, everything has its limits. Most folks have forgotten that Gold-mania (which also extended to Silver, by the way).

Cryptocurrencies have suffered similar fates, and misinformation is the biggest contributor to the mania.

Does it mean there isn’t a legitimate underlying opportunity? Of course there could be. It just means we should be sensible and cautious in our assessments.

Now, let’s look at Gold today:

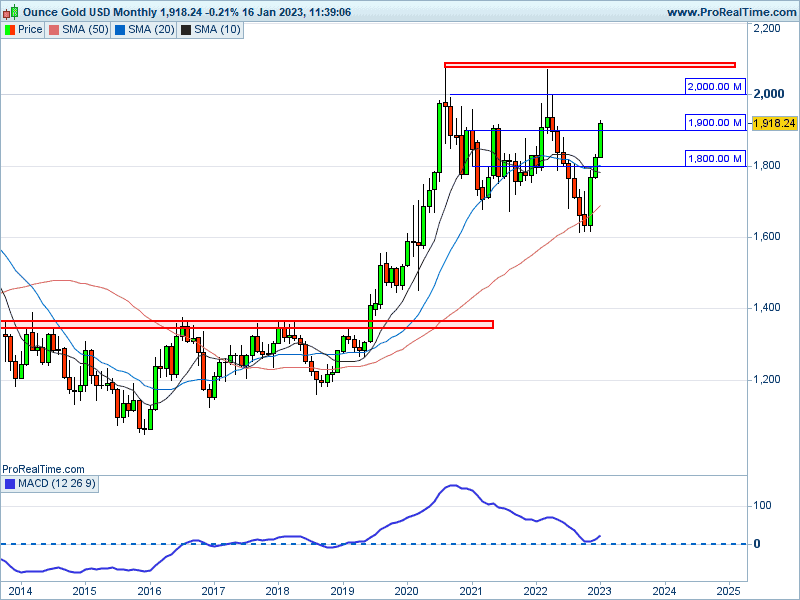

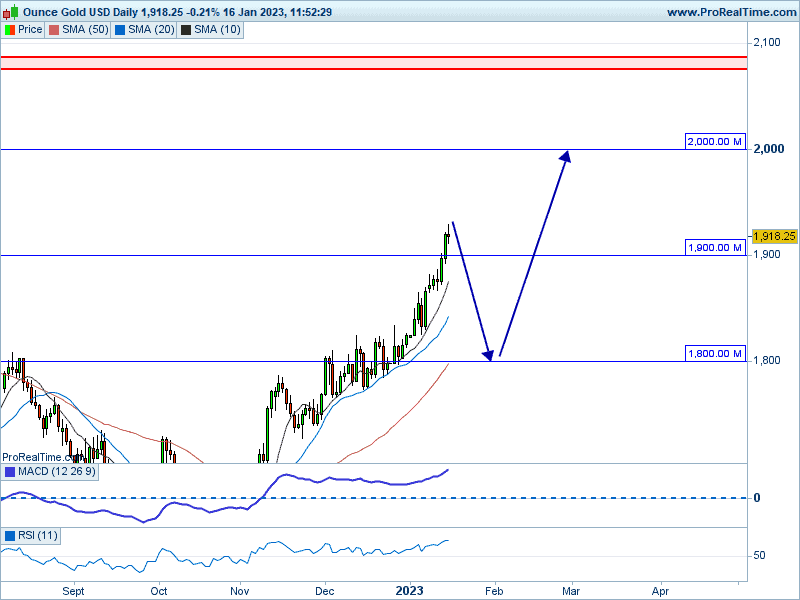

After its breakout in 2019, it very quickly reached a peak of $2.070 (which is its new major brick wall), and after the global quarantine and market correction in 2022, reached a fresh low at $1,600.

Since November 2022, Gold has aggressively climbed back up to $1,900 in an almost straight line. It should be noted that while the global markets were dropping throughout 2022, so was Gold.

Currently, Gold is on track to return to its old highs. The question is how evenly that journey will be.

A very normal, but often overlooked characteristic of all markets is the ‘breathing out’ and ‘breathing in’ of price as it moves- it does not move in a linear fashion, but rather in waves. In fact, a lack of waves is in itself a red flag.

At the time of writing, Gold is now very much due for a retracement (it needs to take a breath in), which could see it return back down to an area between $1,700 and $1,800 before attempting to continue past $1,900 towards $2,000.

Happy Trading!