Good morning, Traders!

For day traders, this time of year can bring mixed emotions- the sleepiness of most markets can sometimes be disrupted by one or two instruments that trend very strongly.

So, traders will have to choose how much of their time they sit in front of the charts as it may not be a satisfying as it usually is.

This time of year can be great for introspection and self-reflection. Did you enjoy your trading this year? Do you feel as though you have settled into a reliable routine? Did you lose sleep over your trading? Should you revise and make changes to your trading techniques.

As much as I love books, I have learned to accept that listening to an audio version will be better for me. In particular, there are a few that will have a greatly positive impact on traders.

The first book that I’ve listened to that comes to mind is “Thinking in Best”, by Annie Duke. A professional poker player discusses why we need to learn to think in terms of probabilities and risk in order to win over time, and that sometimes when we lose, that the strategy still be working just fine.

I’ll take some time to discuss winning books and audiobooks for traders in the future, but this one should definitely be in your stocking this Christmas.

What is the Santa Claus Rally?

According to Investopedia, the Santa Claus rally describes a sustained increase in the stock market that occurs in the week leading up to Dec. 25. However, there seems to be some disagreement over whether these rallies happen in the week leading up to Christmas, or if it’s the week after Christmas until Jan 2.

The week following Christmas is known for being quiet, and prices typically move sideways in extremely small ranges, according to price history. If you give it some thought, this makes sense because there is still a tonne of liquidity in the week before Christmas, when many market participants will take care of year-end position adjustments. Additionally, this pause is probably the result of market players taking a break over the Christmas and New Year’s holidays.

There may even be an expectation of an increase in production of products ahead of Christmas gift orders.

The expected duration of the rally differs depending on who you ask- is it a week, or a month?

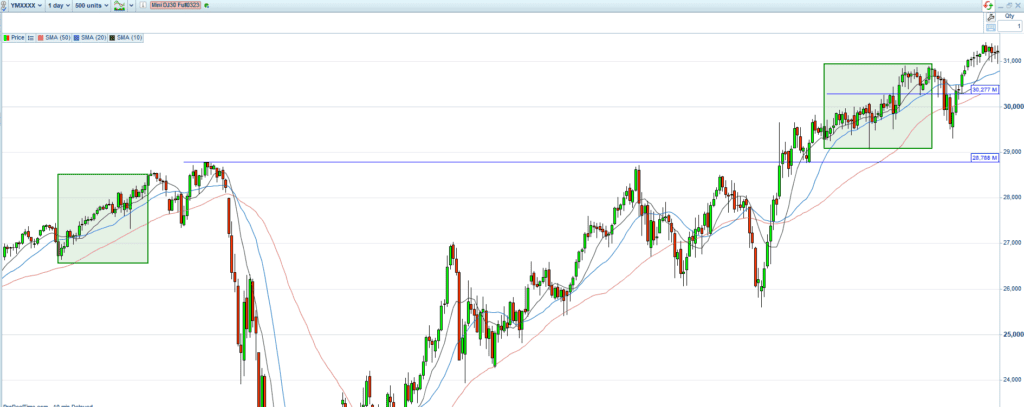

The charts have shown some interesting moves in the past. Of course, past performance may not be a reliable indicator of future behaviours.

In this first chart, we can see that the December to January run on the Dow was clearly bullish for both December 2019 and 2020.

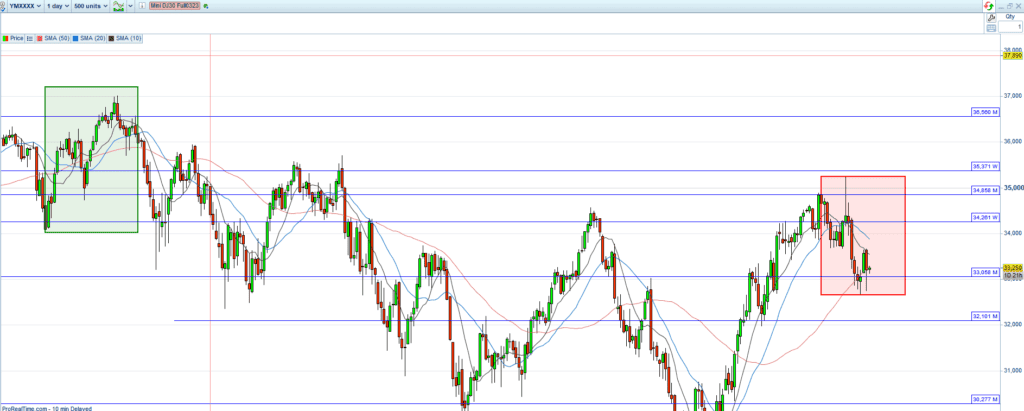

In the follow-up chart, although December to January of 2021/2022 also had a strong bullish move, so far for this year there appears to be no such rally, or if it is still to come, then we’ll have to wait for another week or two.

I hope all of you have been good traders this year, or else this Santa rally could be putting coal in your stocking come Christmas morning!

We need to talk about Tesla

One of the biggest distinguishing characteristics between Traders and Investors is that Traders MUST have an exit plan for each and every trade they take.

Investors should be able to afford the luxury of leaving a stock to bake, while traders have mouths to feed every month. They don’t get paid if they don’t bank profits, and so their timeline for decision making and action is hours, days, and rarely weeks, but never months.

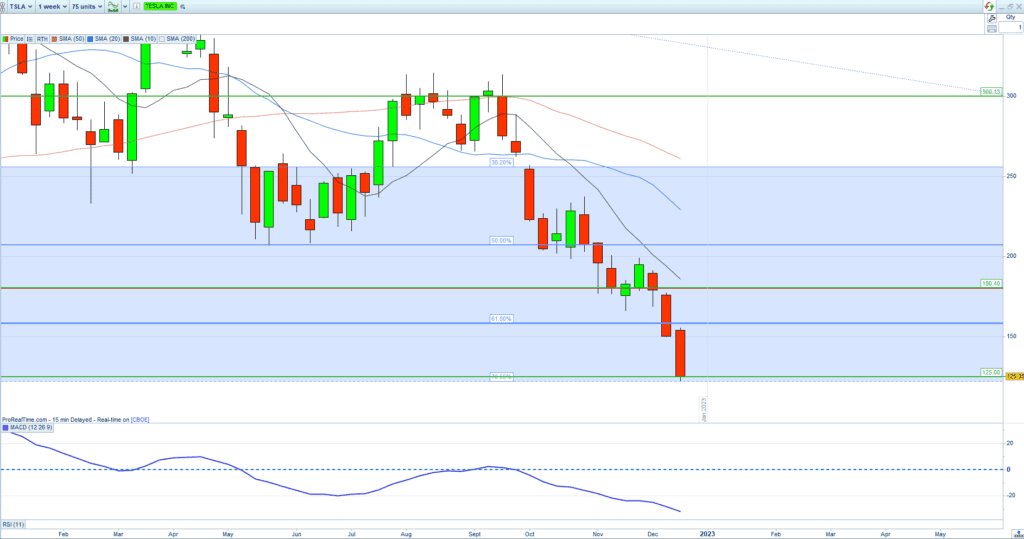

Traders tend to take positions that are in-line with the markets’ immediate trends. So, traders are currently shorting Tesla, as the trend is a downtrend. Tesla is the second most hurting tech stock, just behind Amazon, that’s listed on the NASDAQ 100.

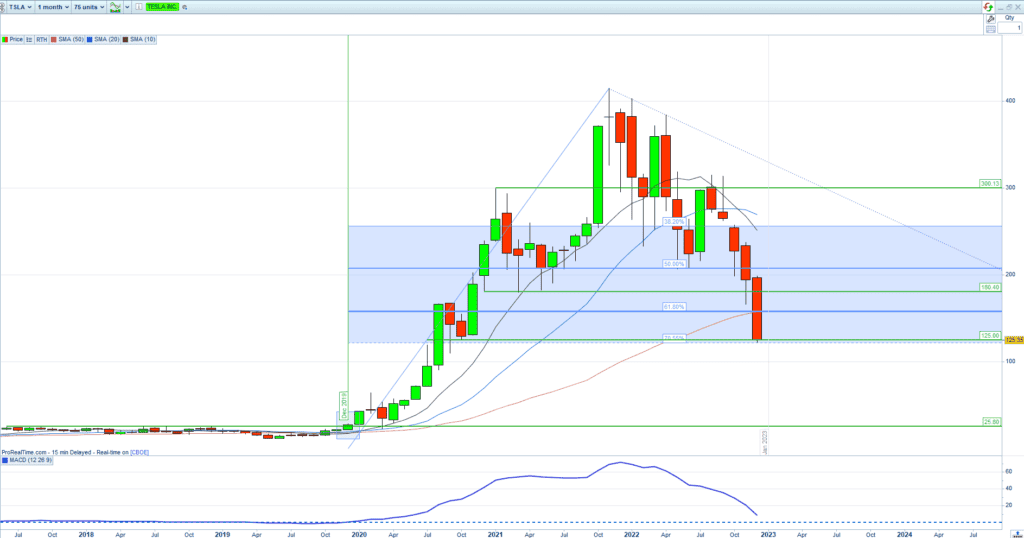

Technical Analysts see a monthly, weekly and daily downtrend on the charts. This means that buying under these types of conditions is not a safe approach and could harm aindividual’s capital.

Most importantly, traders do not become buyers until the trend changes into an uptrend. A monthly chart can take as little as 6 months and as long as 1.5 years to change trends, which means that for investors, it could be a while before TSLA begins to recover from its current lows.

The MACD and RSI indicators are still trending lower across all timeframes, implying that the momentum is ‘motivated’.

What is more likely right now is that its journey into darkness is not over.

Traders- maintain patience and discipline in the face of large scale moves- remember that the weekly and monthly charts help bring perspective to the day-to-day drama that sometimes plays out in the news.

In the famous words of Warren Buffett, “The stock market is a device for transferring money from the impatient to the patient”.

On that note, have a great day, and happy trading!