Welcome to FXGlobe.com’s Weekly Market Overview

This week in the financial markets was a roller coaster of events, affecting currencies, commodities, and indices worldwide. Let’s dive into the key happenings and their implications for traders.

Key Economic Events

Earlier This Week:

- Monday: The week started with a speech from BOE Governor Bailey, setting the tone for the GBP.

- Tuesday: The release of the FOMC Meeting Minutes offered insights into the US Federal Reserve’s stance, impacting USD movements.

- Wednesday: In the US, unemployment claims came in lower than expected at 209K, boosting sentiment towards the labor market. However, the Revised UoM Consumer Sentiment was slightly adjusted upwards, indicating a cautiously optimistic consumer outlook.

- Thursday: Europe showed mixed signals with its Flash Manufacturing and Services PMIs, suggesting ongoing challenges in the Eurozone economy. The UK’s Manufacturing PMI outperformed forecasts, providing a glimmer of hope for the British economy.

- Friday: The US’s Flash Manufacturing PMI slightly underperformed, while Services PMI beat expectations, painting a complex picture of the US economic landscape.

Looking Ahead:

- Tuesday, Nov 28: CB Consumer Confidence in the US will be a key indicator to watch, potentially influencing market sentiment.

- Wednesday, Nov 29: The NZD will be in focus with the Official Cash Rate decision and the RBNZ’s monetary policy statements.

- Thursday, Nov 30: The day will be significant with the OPEC-JMMC Meetings and US economic data releases, including the Core PCE Price Index and Unemployment Claims.

- Friday, Dec 1: A pivotal day for the US with the release of the ISM Manufacturing PMI and remarks from Fed Chair Powell.

Market Analysis

In the Charts:

- Forex and Commodities: The past week saw widespread gains against the USD, particularly notable in the indices. Silver showed potential for further upside, while Crude Oil indicated a struggle in determining its direction.

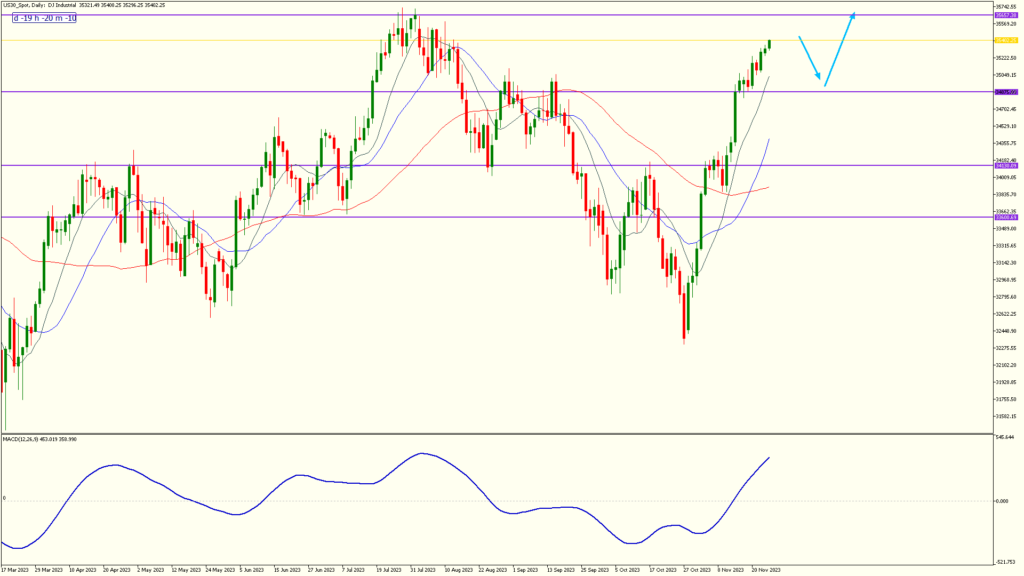

- Indices: After recent gains, technical retracements seem likely, hinting at potential shifts in market dynamics.

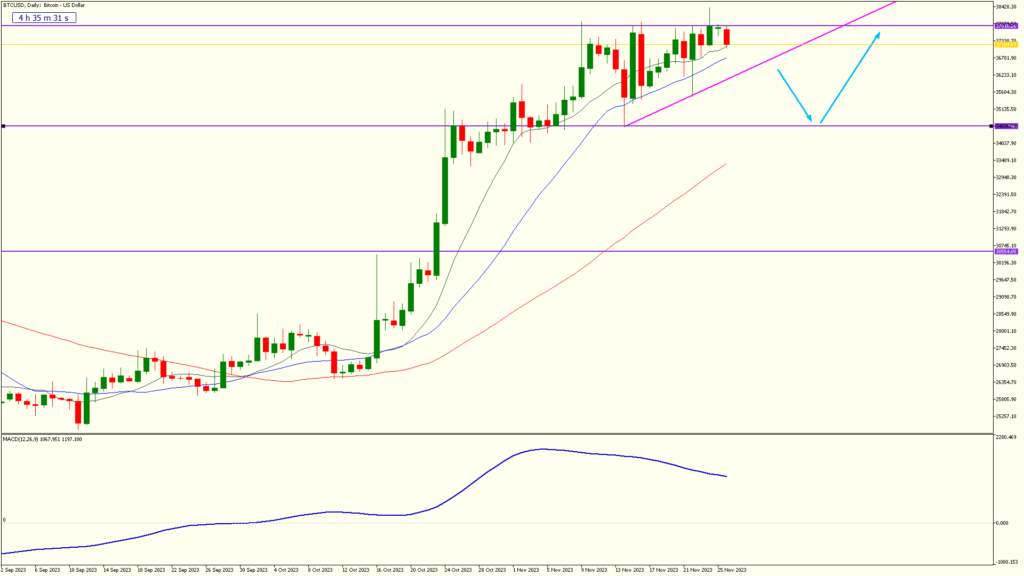

Bitcoin is trying to build up to a bullish breakout here, however, if it falls down through the upwards-sloping trendline, it could head down to the next support level before resuming an uptrend.

The U.S. Indices are nice and bullish, but also due for a natural retracement in the near future.

U.S. Oil is still in a downtrend, but has started to display more mixed sentiment.

Gold really testing resistance at the moment – although there are likely to be sellers pushing back, Gold might achieve brand new highs in the near-to-medium future.

Potential Outlook:

The coming week promises to be just as eventful, with significant economic data and statements on the horizon.

Traders should particularly keep an eye on the developments in the US and Eurozone, as well as any geopolitical events that might influence market directions.

That’s our wrap-up for this week. Stay informed and prepared as we navigate these dynamic markets together. For more insights and trading tips, visit FXGlobe.com. And remember, always trade wisely and stay vigilant!

Related Article: https://fxglobe.com/what-should-traders-do-when-the-markets-are-too-volatile/