Welcome traders, Adam Harris here, your Ambassador to FXGlobe.com. This week, we’ve witnessed some significant shifts in the global markets, signaling a change in economic tides that traders should be aware of.

Key Economic Data Insights

The U.S. economic data released this week has been a central point of interest. The Core Consumer Price Index (CPI) for October reported a lower than expected increase, coming in at 0.2% month-on-month, against a forecast of 0.3%. This flattening inflation trend is crucial, as it may influence future Federal Reserve policy decisions, especially around interest rates and quantitative tightening.

In another major update, reports indicate a pivotal shift in global economic power. Due to the U.S. administration’s concerted efforts to revitalize domestic manufacturing, China’s economy has now slipped to 64% of the size of the U.S. economy.

This marks the first time in four decades that the American economy is growing faster than China’s, reshaping the economic landscape.

The United Kingdom also reported a decrease in inflation, with the Consumer Price Index year-on-year dropping to 4.6%, a significant fall from the previous 6.7%. Additionally, the Producer Price Index month-on-month in the U.S. showed a surprising decline of -0.5%, suggesting easing price pressures in the manufacturing sector.

Upcoming Economic Events

Looking ahead to next week, several key events could further influence market sentiment:

- On Monday, traders will be tuning in to a speech by the Bank of England Governor Bailey for insights into the UK’s monetary policy.

- The FOMC Meeting Minutes on Tuesday are eagerly awaited for hints at the Federal Reserve’s next moves.

- The French and German Flash PMIs for Manufacturing and Services, due on Thursday, will offer a glimpse into the health of the Eurozone’s economy.

- The German ifo Business Climate Index on Friday will provide further clues about the economic sentiment in Europe’s largest economy.

Market Trends and Analysis

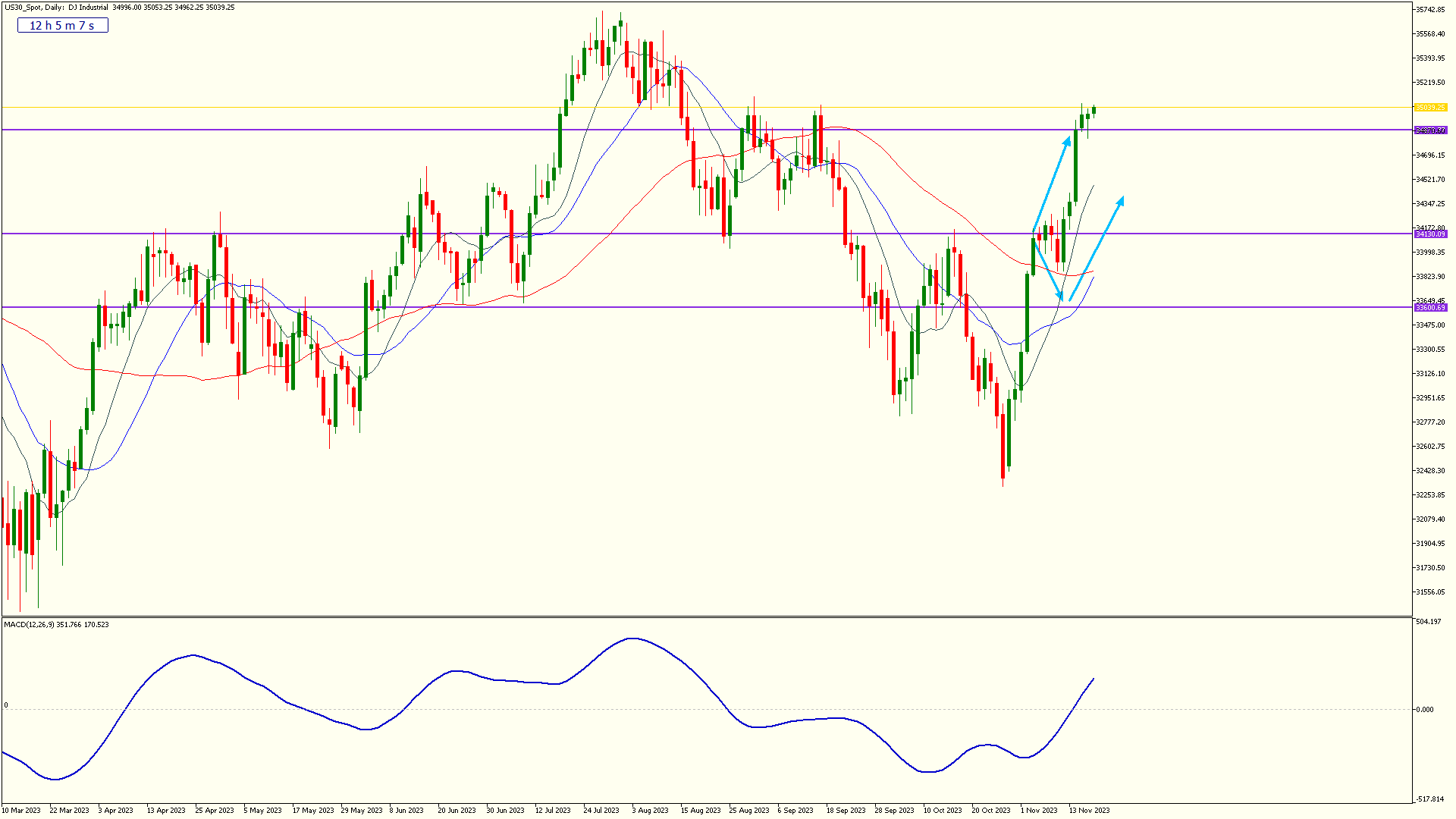

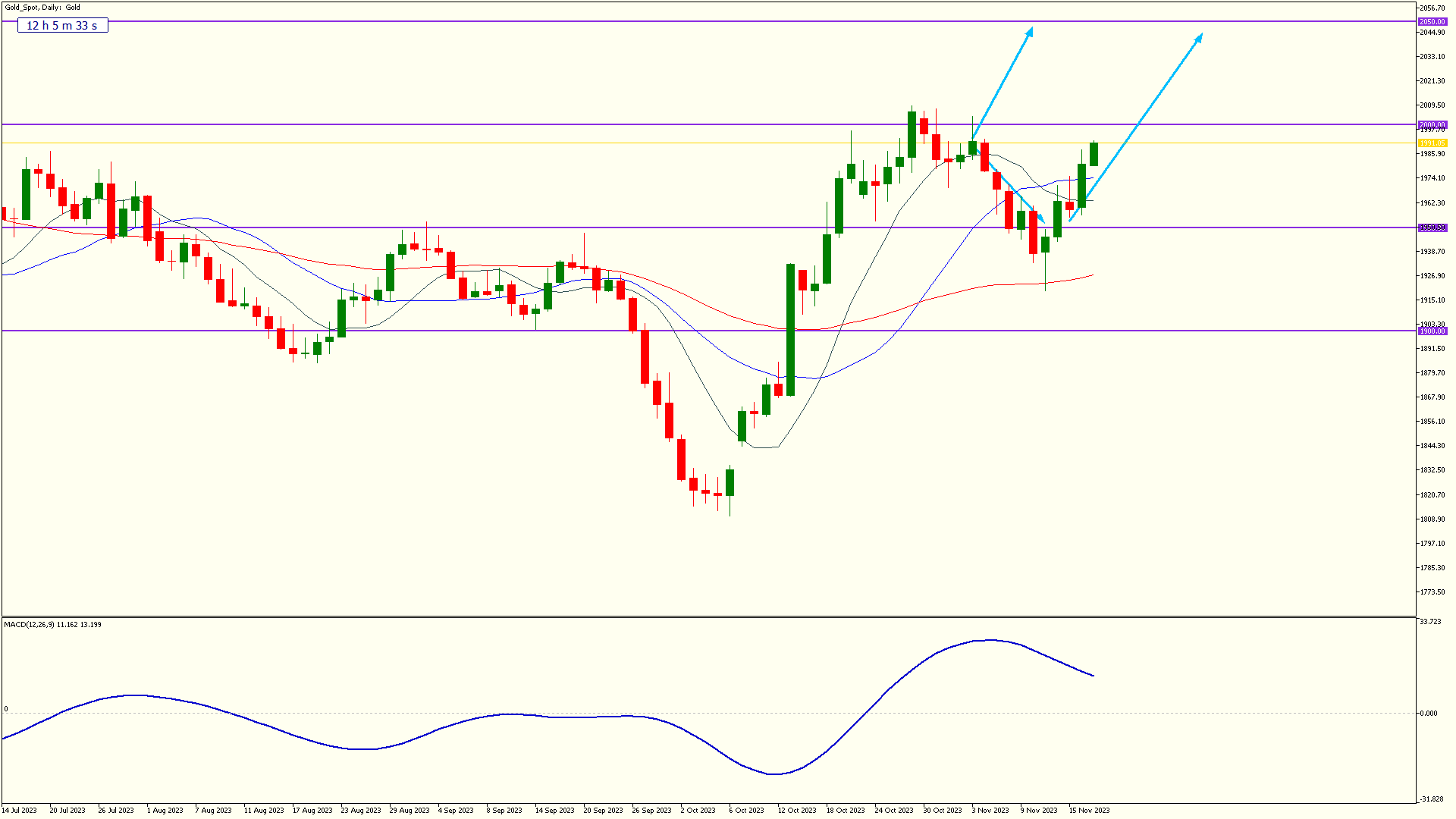

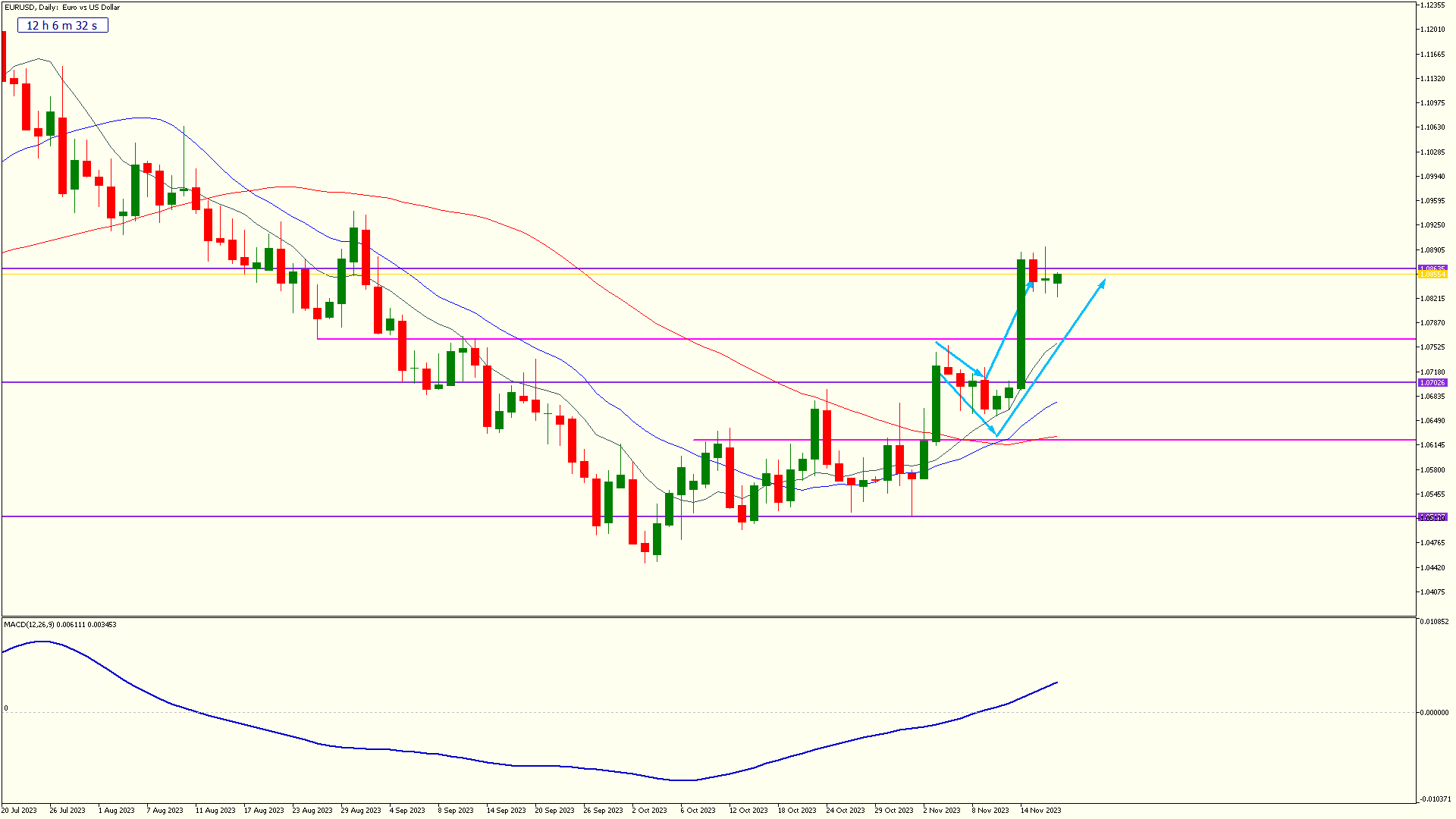

From a technical standpoint, this week has seen the U.S. Dollar weaken significantly, which in turn has led to notable movements across various asset classes. Forex pairs, precious metals, and global indices have all rallied against the USD. This emerging bullish trend across these markets could potentially offer medium-term trading opportunities, especially for trend-following strategies.

⚡ Cryptocurrencies, particularly Bitcoin and Ethereum, have shown substantial gains, suggesting increased investor confidence in digital assets amid broader market fluctuations.

Looking at the Dow, we can see an extremely bullish move without any pauses or breaks.

Gold has also enjoyed a solid rebound from recent lows.

And the EURUSD appears to be pausing at a key level. We can bullish sentiment settling in here.

Conclusion

As we head into another week, it’s essential for traders to stay vigilant and adapt to these shifting market dynamics. The global economic landscape is undergoing significant changes, and being attuned to these developments will be key in identifying potential trading opportunities.

Remember, trading success comes from informed decisions and a calm, strategic approach. Stay updated and ready to capitalize on the movements in the market.

That’s all from me for now. Keep calm and carry on trading, and for more insights and updates, visit FXGlobe.com.

Make the most of your market knowledge by following Adam Harris’s detailed breakdown of the latest updates.