Recapping the Week

This past week in the financial markets was marked by several important economic releases. The ISM Services PMI in the US painted a picture of resilience in the service sector, surpassing expectations with a reading of 52.7. However, a slight drop in JOLTS Job Openings to 8.73 million hinted at a cooling job market.

Mid-week, the focus shifted to the UK with BOE Governor Bailey‘s speech amidst ongoing economic challenges. The US also reported a moderate increase in employment through the ADP Non-Farm Employment Change, adding 103K jobs, which was below the anticipated figure.

The week concluded with the US Unemployment Claims, which held steady, reinforcing the stability of the job market. These figures are crucial as they provide insights into the overall health of the economy.

Current Market Analysis

As we review the charts, the strength of the dollar stands out, particularly its impact on commodities and indices. Gold experienced a significant sell-off, dropping from the 2,150 level. This movement reflects the market’s sensitivity to shifts in the dollar’s strength. The indices, though showing a slight decline, indicate a market that is cautiously waiting for further cues.

Bitcoin, along with other charts had a minor stall after a long rally- could this stall be preceding a larger correction?

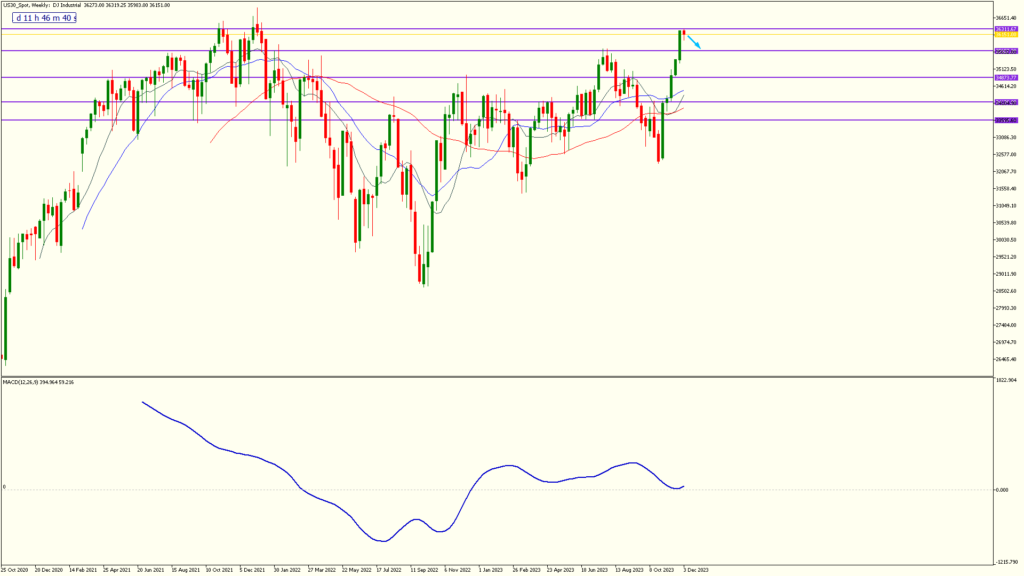

Here the Dow is sitting at major highs (resistance) after a long rally. Often, price will take a small breather down to the nearest support level- we will have to see if this is how it plays out here.

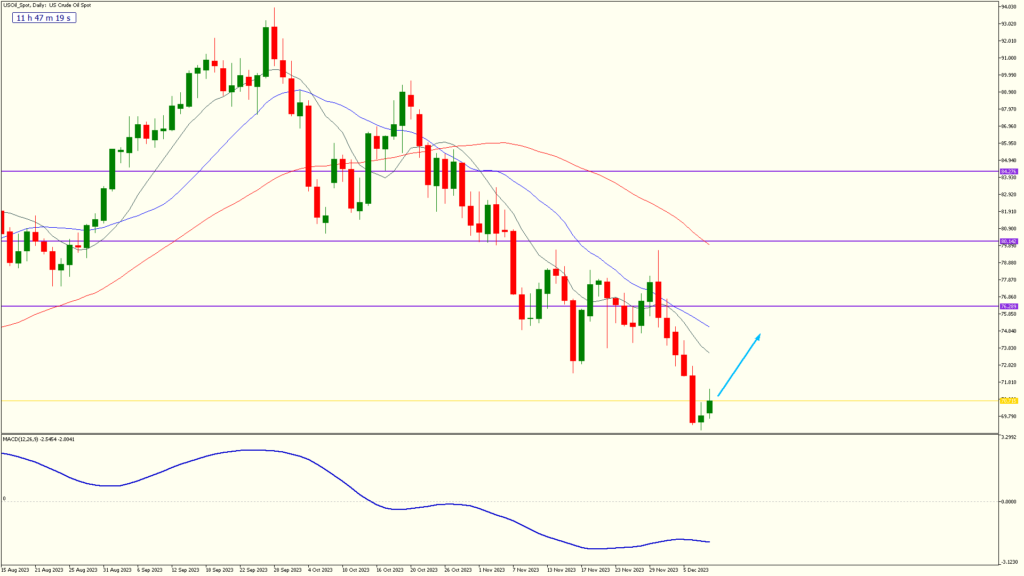

US Oil has begun a retracement after a good run down recently. Over the coming days it could continue this temporary rally within the downtrend until it finds resistance.

Gold had its snout booped at the historic high level- the question is, will it recover from this and have another run over the next week?

Gold had its snout booped at the historic high level- the question is, will it recover from this and have another run over the next week?

Looking Ahead

The upcoming week promises to be eventful. Starting with the UK’s Claimant Count Change and the US Core CPI, these figures will be pivotal in shaping market sentiment.

The Federal Reserve’s decision on the Federal Funds Rate, along with the FOMC Economic Projections and Statement, are highly anticipated and could lead to substantial volatility, especially in the USD markets.

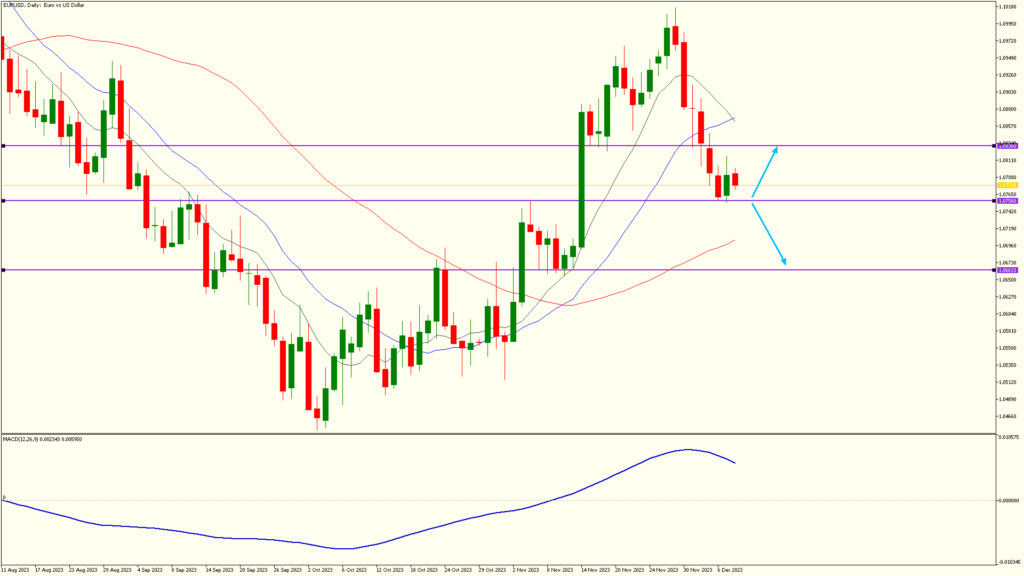

In the Eurozone

The ECB’s Main Refinancing Rate and subsequent press conference will be closely watched, offering insights into the monetary policy direction amidst varied economic challenges. Retail Sales and Unemployment Claims in the US will provide further clarity on the consumer and labor market.

As we approach the week’s end, the manufacturing and services PMI figures from France, Germany, and the UK will offer a snapshot of economic activity in these key European economies. These indicators are essential in understanding the broader economic picture in a post-pandemic world.

So, this week has shown us the resilience and volatility that define our current economic landscape. As traders, it’s crucial to stay informed and adapt to these changing dynamics. Remember, trading is about understanding not just the numbers, but the stories they tell.

Keep Calm and Carry On Trading! For more in-depth analysis and trading insights, visit FXGlobe.com.