FXGlobe’s Weekly Update

Traders,

It’s Adam, your trusted FXGlobe.com Ambassador, back with another dose of market insights and upcoming trends. This week was packed with economic data releases and significant chart movements. So, without further ado, let’s dive right in!

The Week in Review: Data Deluge and Market Moves

European Numbers:

-The Flash PMIs out of France and Germany were somewhat mixed this week. Manufacturing seems to be slowing down, while the services sector appears more resilient. These numbers are key indicators of economic health, so traders should keep an eye on them as they fluctuate.

The British Market:

The UK saw its Flash Manufacturing PMI dip below expectations, though the Services PMI managed to hit its mark. Given the volatile nature of post-Brexit Britain, these numbers will continue to be closely watched.

Across the Pond:

In the US, Flash Manufacturing and Services PMIs both slightly edged higher than last week, but the unemployment claims were a bit of a letdown, coming in below last week’s numbers. The German IFO Business Climate Index was slightly disappointing, falling lower than predicted, which may imply a cooling of business sentiment in Europe’s largest economy.

Technical Summary:

The USD had another strong week, putting pressure on major currencies and commodities. However, it was a fantastic comeback week for both Gold and Silver. Global indices saw a roller coaster ride, soaring to new highs midweek before retreating.

What to Watch Next Week

For Aussie Traders:

On Tuesday, RBA Governor Bullock will deliver a speech, followed by the year-over-year CPI data on Wednesday, expected at 5.4%.

U.S. Insights:

A busy week in the US starts with the S&P Composite’s year-over-year performance on Tuesday, with a forecast of -1.7%. The CB Consumer Confidence and JOLTS Job Openings are also on tap. Employment and GDP figures round out the week, with a Non-Farm Employment change and a preliminary GDP for the quarter estimated at 2.4%.

The Eurozone:

The German Preliminary CPI is scheduled for Wednesday, while Spain’s Flash CPI, expected at 2.3%, will also be under the microscope.

Hot Charts to Eye

GBPJPY appears healthy and bullish, but with some potential resistance up ahead.

Gold is attempting to form a double bottom at support, but will it be able to push the strong USD back as well?

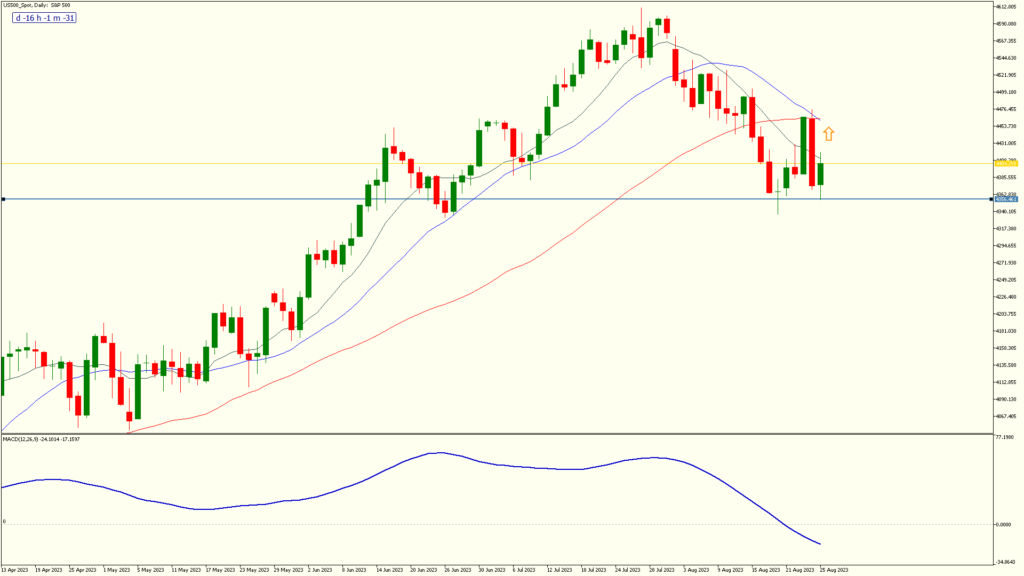

The SP500 also appears to have formed a double bottom on support. This coming week will be interesting to watch this.

USDJPY, similar to GBPJPY above, shows bullish intent, but sits right on resistance. A break above this could be significant.

If you’re a technical trader, Gold and Silver are looking more appealing than ever. Global indices are also expected to make some significant moves, which could offer excellent opportunities for keen market participants.

That wraps it up for this week, traders. Thank you for tuning in. Keep building those good habits, stay tuned to the news, and let’s meet those financial goals!