Hello traders, and welcome to this week’s edition of our Market Review. Not to make things about me, but it’s my birthday! Nevertheless, the market waits for no one, so let’s get right into the week’s key highlights and upcoming events.

Last Week’s Economic Indicators

- U.S. Core PPI m/m: The Producer Price Index for the United States beat forecasts, coming in at 0.3%, compared to the expected 0.2%. This may be an early indicator of increasing inflationary pressures.

- U.K. GDP m/m: The Gross Domestic Product for the United Kingdom matched forecasts, maintaining stability with a 0.2% monthly growth rate.

- U.S. CPI and Unemployment Claims: Unemployment Claims were steady, and the Consumer Price Index numbers signaled ongoing inflationary pressures.

The State of the Markets

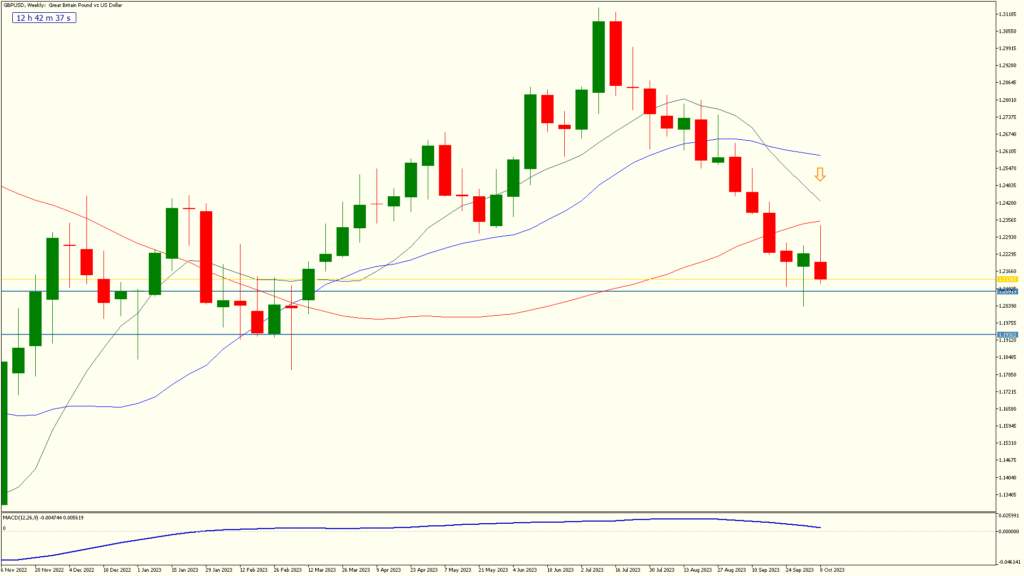

In chart analysis, the U.S. Dollar made a strong comeback towards the week’s end. Though still viewed as over-extended and ripe for a broader correction, this doesn’t seem to be in the cards for this week. Therefore, traders should remain cautious.

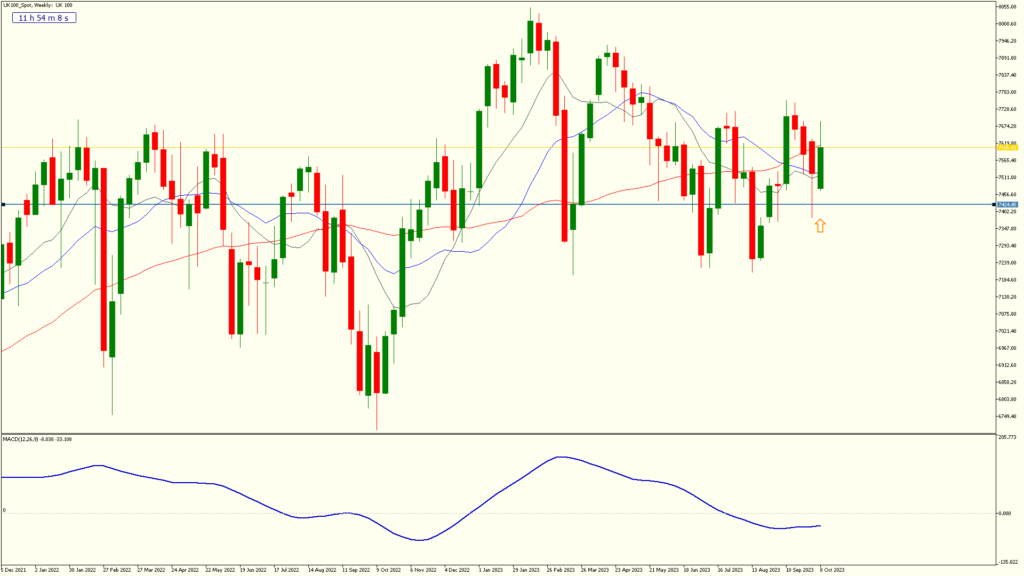

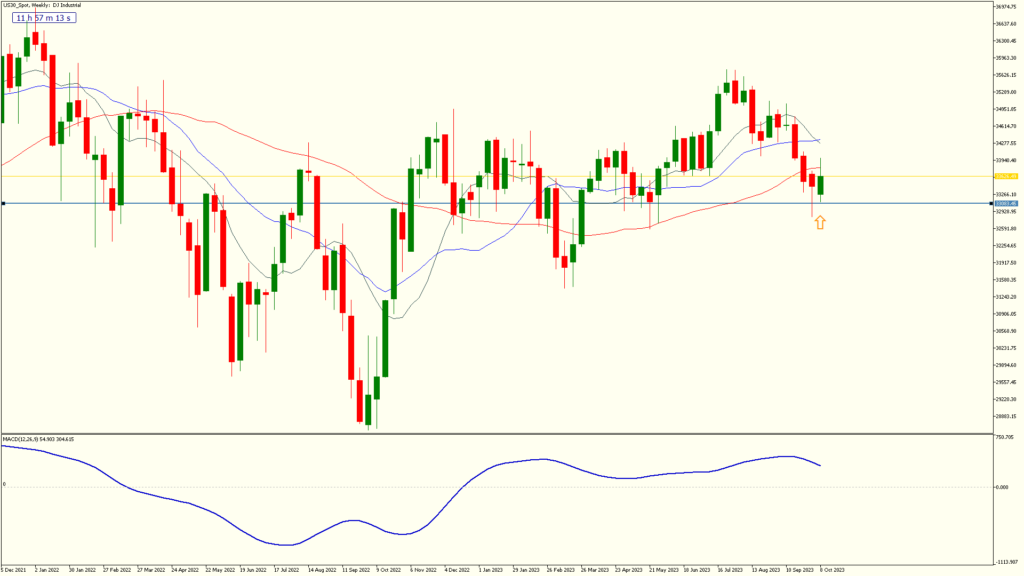

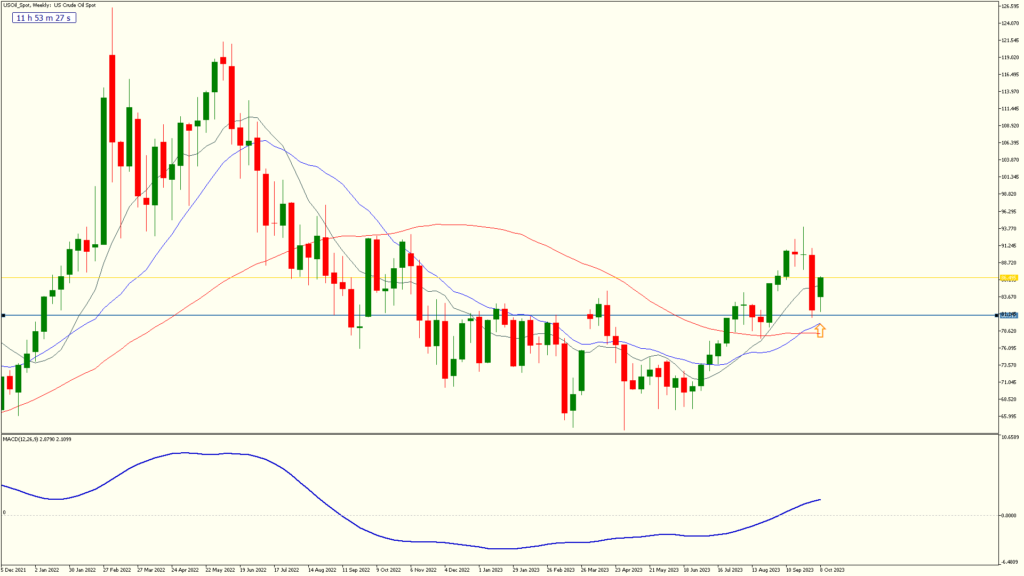

Gold and Crude Oil seem to be poised for a bullish run. Indices are also seeing some buying activity, but not as strongly as commodities. The cryptocurrency market remains under pressure, which could be an opportunity for contrarian traders.

Charts of Interest

GBPUSD (similar to EURUSD) weekly chart show a trend-continuation candle right near support. This make it likely that price ‘wants’ to keep going lower, but could also encounter resistance at the levels as well. Enough to turn it around? Too soon to tell.

Gold is the clear winner here, with a rare and impressive burst higher. Aside from natural retracements, it’s not unreasonable to expect it to keep this up.

UK100 not looking bad at all. A fair possibility of moves higher in the coming week.

The US30 also looking tentatively bullish, with the emphasis on tentatively.

US500 has attracted some buyers, but enough to turn it around here?

US Oil looks incredibly bullish here. Clean uptrend and solid on support.

What’s On the Horizon?

- U.S. Empire State Manufacturing Index: A significant dip is projected, falling to -6.4.

- New Zealand’s CPI q/q: An uptick to 1.9% is forecasted, which could stir some market action in the NZD pairs.

- U.K. Claimant Count Change: Expected to rise, reflecting potential volatility in the GBP.

- U.S. Retail Sales m/m: A dip is anticipated, which could have repercussions for consumer-related stocks and the USD.

And don’t forget to mark your calendars for Fed Chair Powell‘s speech later in the week. It’s bound to have implications for the U.S. Dollar and possibly broader markets.

That wraps up our weekly review. To learn more, visit FXGlobe.com. Remember—keep calm and carry on trading!