Good morning Traders!

Well, it’s Australia’s central bank turn, and the Reserve Bank of Australia is going to announce it’s interest rates decision tomorrow. Following a hotter then expected CPI reading, the market is expecting another 0.25% rate hike, which will bring the Cash Rate to 3.35%

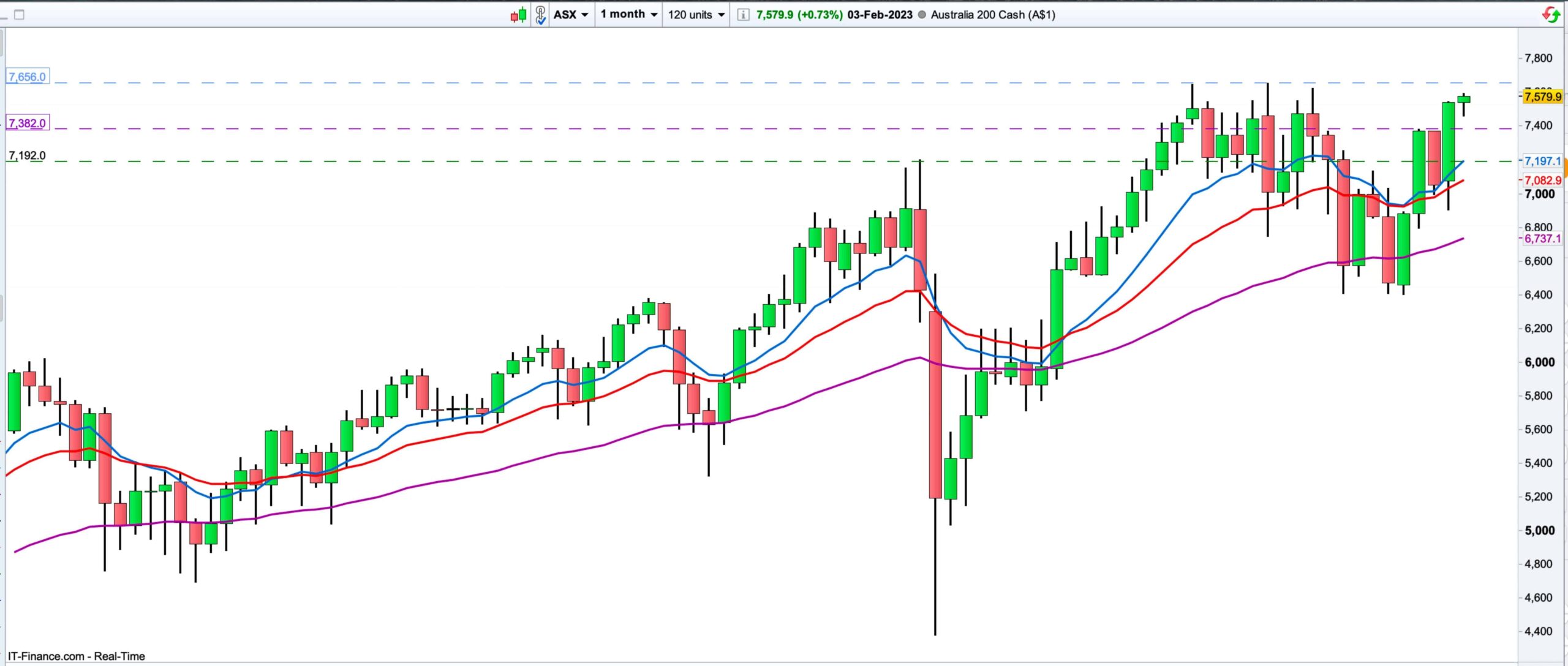

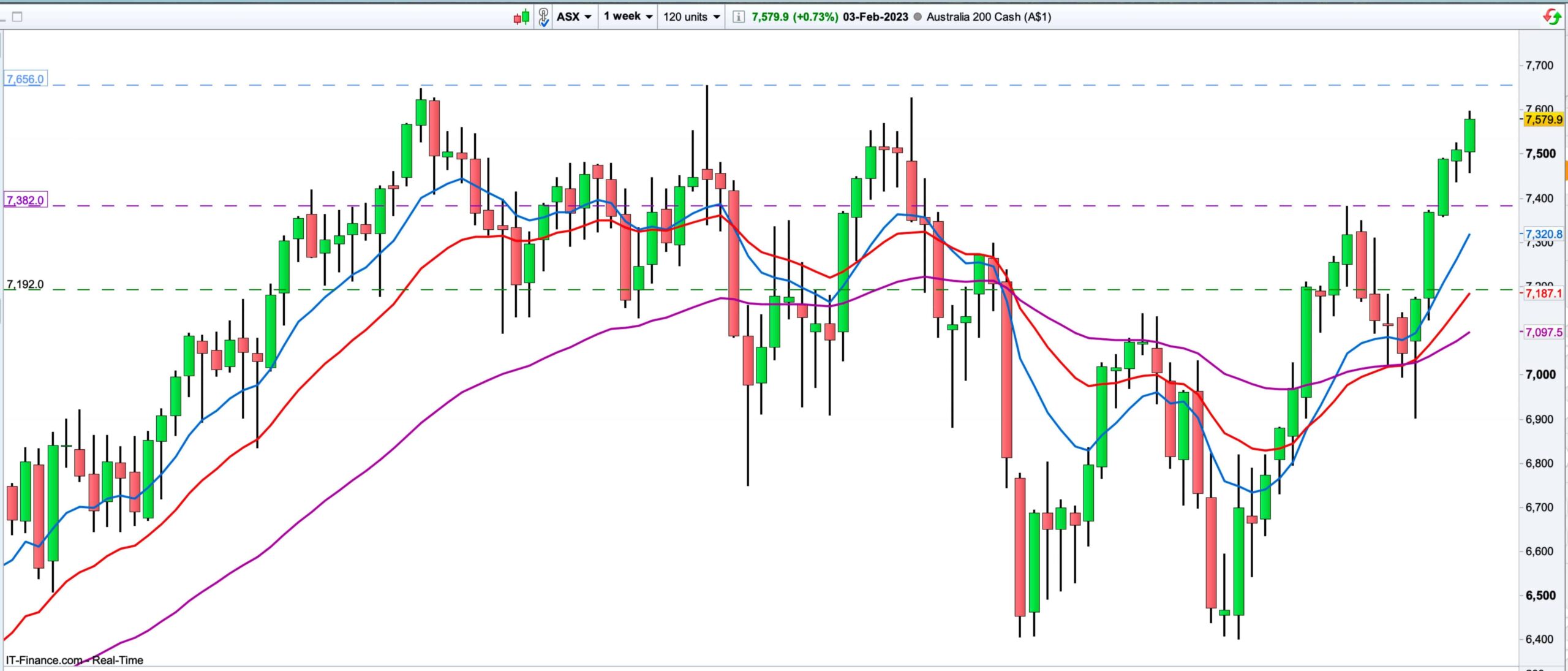

ASX 200

After several attempts by the sellers to break through the Support level at around the area of the 6400, the market has staged a rally from that low point. The market is in an uptrend on both the Daily and the Weekly timeframes, with the strong Resistance level, and the all times high, of around the 7660 area in sight once more.

The market is currently quite overextended from it’s Moving Averages, and I am looking for a pullback to release some of this very strong buying pressure. There are two levels that I am interested in. The top one, in case of a shallower pullback, is around the 7380 area, which is the previous High on the big picture.

The lower level, in case of a deeper pullback, is around the 7190 area. This level was the breakout level on the daily chart and has been tested a couple of times, and quite precisely, before the market rallied from there.

As always, I’ll be looking at the lower timeframes for signs that the pullback is over, and the buyers are ready to take control once again.

Happy Trading!