Incorporating the latest technology and forward-thinking design principles, Tesla Corporation has emerged as a dominant force in the world of electric vehicles (EVs) and green energy.

Established nearly two decades ago by visionary entrepreneur Elon Musk (alongside a team of like-minded innovators), the American-based tech firm has garnered widespread recognition for its groundbreaking products, which continue to lead the way today.

Trading under NASDAQ’s TSLA designation since going public just over ten years ago, interest among investors has skyrocketed. Consumer interest has also surged, signalling substantial growth potential ahead. With Tesla’s technology continuing to shake up traditional automotive industry norms, it’s attracted global interest from consumers and investors alike. I mean, who wouldn’t want a slice of such a lucrative opportunity?

But for potential investors, evaluating whether to purchase shares in Tesla can be tricky given the technical complexities surrounding stock market investments.

Don’t worry, though. We’re here to guide you through all the crucial aspects worth examining before you make any sort of commitment to Tesla. Keep reading to find out more.

Factors Influencing Tesla Stock Price

Tesla’s stock valuation is affected by many factors, both obvious and hidden, that can impact investors’ decisions.

Positive factors include strong financial performance, increasing demand for electric vehicles, and government incentives for green technology. But there are also major risks. Unless you’ve been living under a rock, you’ve almost certainly been privy to Elon Musk’s unpredictable tweets and erratic behavior. Then there are the potential quality issues with Tesla’s products.

Understanding these factors is crucial for anyone considering investing in Tesla.

Pros and Cons of Investing in Tesla

When considering investing in Tesla stock, it’s important to weigh up the pros and cons.

Pros

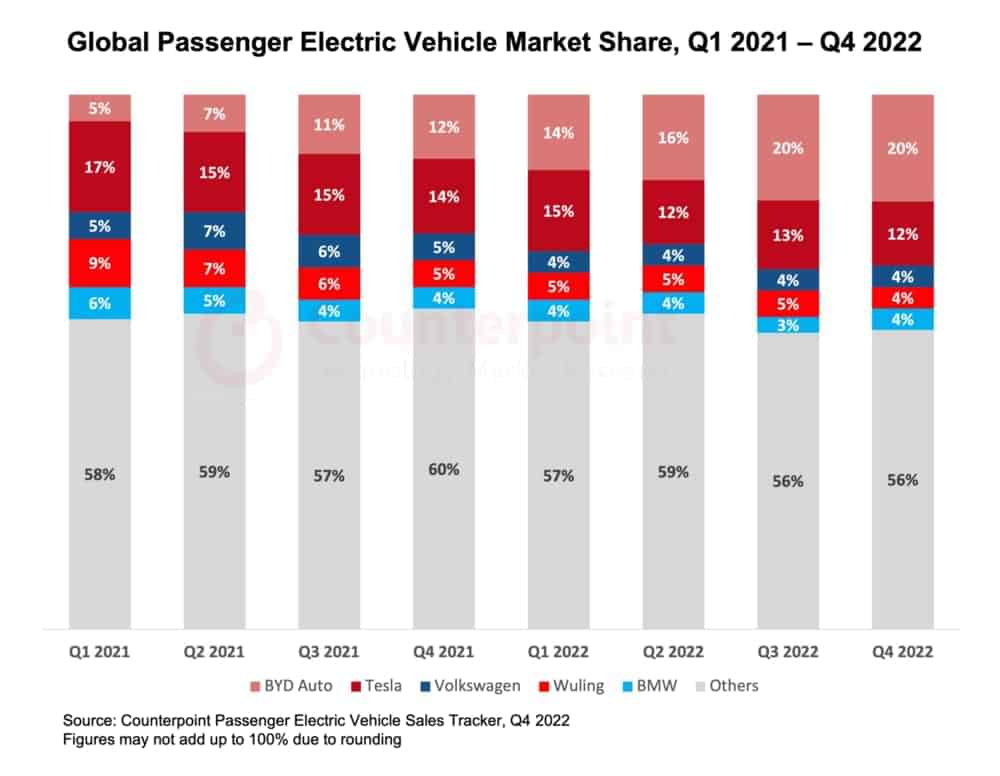

- Market leadership: Tesla dominates the EV industry, with a significant share of the worldwide electric vehicle market. This allows Tesla to outperform its rivals and achieve increased economies of scale.

- Innovative technology: Continuous innovation and advanced technology are at the core of Tesla’s success. This has helped them stay ahead in the EV market and attract a growing number of satisfied customers.

- Strong brand: Tesla’s commitment to environmental responsibility has helped build a globally recognizable brand. Its unwavering dedication to sustainability has proven attractive to customers who care about clean energy, and the company boasts an impressive 67.2% loyalty rate.

Cons

- High valuation: The exponential rise of Tesla’s stock price has caused some investors to worry that it’s overvalued and could fall in the future.

- Competition: The EV industry is witnessing intensifying competition day by day. This may ultimately impact Tesla’s bottom-line figures as it strives to maintain its position in the market.

- Production challenges: Tesla has faced production issues in the past, which have led to delayed deliveries. As demand continues to increase, similar problems in the future could harm its stock value.

Analyzing Tesla’s Financial Performance

Investing in Tesla stocks requires careful consideration of the company’s financial performance to reduce risks.

The company’s financial success is measured using indicators such as profit, revenue growth, and cash flow. Its soaring revenue can be largely put down to the increasing demand for electric vehicles. An increase in production due to new EV model releases has also played a key role in its finances.

However, achieving consistent sustainability may pose a challenge for Tesla—given its historical struggle to achieve sizeable profit margins.

Then again, the company’s ability to report profits over consecutive quarters shows positive signs for potential investors due to its upward trajectory. Furthermore, Tesla has improved gross margins which implies it is becoming more efficient in production and operations.

Finally, let’s consider Tesla’s cash flow as a critical aspect of financial performance. Positive cash flows from operations have enabled the company to fund growth initiatives and meet debt obligations.

Tesla’s Position in the Electric Vehicle Market

One thing that sets Tesla apart from other EV manufacturers is its dominant presence in the global marketplace. In fact, recent studies show Tesla commanded roughly 16% of total EV sales worldwide throughout 2020—a substantial lead over any rival in this sector.

Tesla plans to extend its industry reign by investing in production facilities, as well as research and development to improve battery technology. The company intends to expand in both traditional and EV markets.

With an effort to address one of the main concerns among potential EV buyers, Tesla has invested heavily in its Supercharger network—a fast-charging infrastructure designed for fast and efficient battery charging. This network, which now spans globally, lets Tesla owners enjoy worry-free journeys with less time wasted on charging stops.

This investment not only bolsters sales but also gives Tesla a competitive edge over other automakers.

The Role of Elon Musk in Tesla’s Stock Performance

Elon Musk is a vital figure at Tesla, having played a major role in its success as CEO and co-founder. His leadership and innovative ideas have helped the company become what it is today.

However, it’s also important to note that his influence goes beyond the company itself. Musk’s tweets and public appearances have the power to impact Tesla’s stock value, which can be both positive and negative.

It’s important for investors to consider the impact of Musk on Tesla’s stock performance when making investment decisions. While he has undoubtedly been a major force in the company’s success, investors should focus on company metrics rather than external factors when evaluating its long-term investment potential.

Comparing Tesla With Other Automotive Stocks

Before investing in Tesla, it’s important to compare its position to other players in the automotive industry. This analysis can offer a valuable perspective on Tesla’s potential for growth and worthiness as an investment opportunity.

When evaluating Tesla’s performance metrics, key indicators to consider include price-to-earnings (P/E) ratio, price-to-sales (P/S) ratio, and revenue growth data. These factors provide investors with valuable insights into whether Tesla’s stocks are worth purchasing.

Tesla’s valuation metrics, such as its P/E and P/S ratios, are significantly different from traditional automakers like Ford, General Motors, and Volkswagen. Tesla’s high valuation is primarily due to its exponential revenue growth, cutting-edge technology, and domination of the hybrid-electric vehicle market.

However, investors should be cautious when investing in Tesla due to its high valuation and consider weighing the company’s growth prospects against its premium valuation.

External Factors Affecting Tesla Stock (e.g. Government Policies and Competition)

Tesla’s stock prices are influenced by external factors such as government policies, competition, and macroeconomic conditions.

- Government regulations: Tax incentives, subsidies, and infrastructure investments can drive demand for electric vehicles, benefitting Tesla. However, policy shifts or reduced incentives may cause adverse effects on Tesla’s sales volume and stock price.

- Competitive pressures: Tesla must navigate an increasingly competitive landscape for electric vehicles, as traditional manufacturers and emerging companies vie for a piece of the market. As pressures mount, it could challenge Tesla’s hold on market share, translating into lower sales figures or profitability.

- Macroeconomic factors: Economic expansion, consumer sentiment, and interest rates play a significant role in shaping Tesla’s stock price. Rising interest rates may increase borrowing costs for Tesla and its consumers, affecting vehicle sales and the firm’s capability to finance future endeavors.

How to Decide if Tesla Stock is Right for Your Investment Portfolio

Deciding whether to invest in Tesla stock isn’t a simple yes or no answer. It all depends on your investment goals, risk tolerance, and how long you plan to hold onto the stock.

If you’re looking for a long-term investment and interested in the growing market for electric vehicles, then Tesla might be a good fit for your portfolio. They’re a leader in the EV industry, have innovative technology, and a strong brand presence that could lead to future growth.

However, if you’re not comfortable with high-risk investments or have a shorter investment timeline, Tesla’s high valuation and potential for volatility might not be a good match for you.

Ultimately, before you decide to invest in Tesla, take the time to carefully consider your investment goals and how much risk you’re willing to take on.

Expert Opinions and Predictions for Tesla’s Future

Experts have varying opinions and predictions about Tesla’s future stock performance. Some believe that Tesla’s revolutionary battery technology and leadership position in the electric vehicle industry make it a great investment opportunity.

However, others express concerns about the company’s high valuation, intense competition from major automotive players, and the challenges of scaling up manufacturing capacity.

Investors must conduct thorough research before making any investment decisions, especially when dealing with a stock as dynamic as Tesla’s. It is essential to keep track of both the positive and negative developments surrounding Tesla to gain a comprehensive understanding of the company’s future prospects.

Conclusion: Making an Informed Decision on Tesla Stock Investment

The electric vehicle market is booming, and investing in Tesla shares may be a smart choice for long-term investors. With its innovative technology, strong branding, and leading position in the industry, Tesla has a promising future. However, investors should also consider the potential risks—like the company’s high valuation and increasing competition from other players.

Moreover, Elon Musk’s influence on the company’s stock performance adds yet another layer of complexity. It’s crucial to conduct thorough research on Tesla’s financial progress, industry peers, and external factors affecting its stock value before making any investment decisions.

In summary, investing in Tesla stock can be a rewarding venture for those with a long-term outlook and a willingness to accept some level of risk. However, it’s essential to carefully evaluate Tesla’s financial performance, market position, and external factors affecting its stock price before making any investment decisions.

Finally, always ensure that your investment aligns with your personal investment goals, risk tolerance, and time horizon to ensure a successful investment experience.